We help Canada’s tech founders start, grow and succeed.

We help Canada’s tech founders start, grow and succeed.

Starting and scaling a tech company is anything but easy. We’re here to help at every step. For more than 25 years, we’ve helped founders like you build strong teams, access capital and commercialize products.

Join Communitech to get connected – to peers who have been there before, coaches who can guide you through the tough spots, and public and private partners to help you compete globally.

“I felt supported every step of the way, as coaches were adding value and the content was relevant to my business”

- Assel Beglinova, CEO of Paperstack

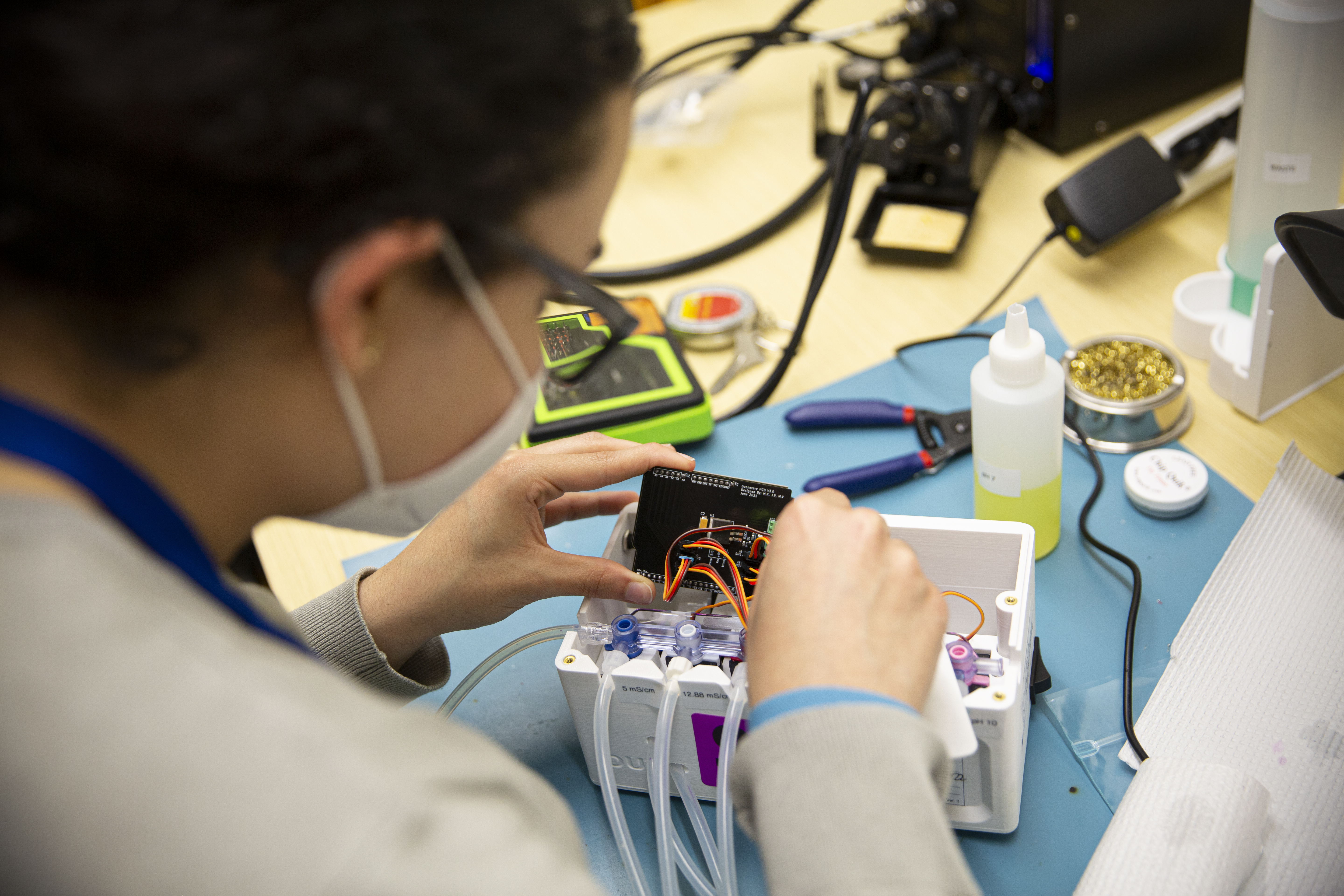

Purpose-built for the tech community

Communitech was brought to life by founders who saw the need for a community of support for Canadian tech. Our products are directly informed by needs identified by our tech community.

COMMUNITECH HIVE

Elevate your leadership, build a community

The Communitech Hive offers dynamic leadership development for Canadian tech teams, through individual programs and custom team sessions.

COMMUNITECH TENANCY

Looking for workspace at the heart of tech?

From individual day passes to dedicated team spaces and suites, rental options at the Communitech Hub cover companies of all sizes.

COMMUNITECH FAST TRACK

Want to connect with big customers?

Communitech’s Fast Track collaboratives connect you with partners who are ready to validate ideas and explore solutions.

80,000+

square feet of office and co-working space available to our tenant companies

1,200+

Communitech members

28

Peer2Peer Groups with 12,800+ participants

25+

years serving Canadian tech founders

We’re all about the “F” word.

Founders, that is. Established in 1997 by a group of tech founders, our mission to help has been our guide for more than 25 years.

Today, Communitech consists of roughly 100 awesome humans, all pulling together to help Canada’s founders start, grow and succeed.